All interest on US savings bonds are treated as standard income for income tax related purposes. You may opt to pay tax on interest before they are cashed. How do taxes on savings bonds work?īoth types of bonds are tax-deferred, in that you do not pay taxes on interest income until you redeem the bond. Fixed rates and variable CPI rates are announced every 6 months around May 1st and November 1st. You can find the current I bond rate at the website. Due to this behavior, I-series bonds are typically regarded as type of inflation-protected investment. New fixed rates as well as the inflation component are announced in May and November of each year. I-Series bonds are purchased at face value, and their interest rate a combination of a fixed rate set at the date of purchase, and a Consumer Price Index (inflation) component. Due to this guaranteed doubling, newer issued bonds have an effective minimum compound annual interest rate of around 3.53% if cashed exactly 20 years after purchase (older bonds that double in 17 years have a higher effective rate of ~4.16%). EE bonds are guaranteed to be worth at least their face value 17/20 years after purchase (see below section marked "Should I cash my savings bond?" for more information). What is the difference between an EE-Series Bond and an I-Series Bond?ĮE-Series bonds are purchased at half face value, and their interest rate is based on either the average of the 5-year Treasury Note, or the 10-year Treasury Note, depending on the bond's age. For instance, Treasury Inflation-Protected Securities (TIPS), while a good tool for protecting some invested money against inflation, are not considered savings bonds, and also can lose value if deflation occurs. Lastly, there are other types of bonds issued by the Treasury that are not considered savings bonds. This wiki entry does not cover E- or HH-series bonds. There are also a couple types of savings bonds that are no longer issued but may still be valid, namely E-series and HH-series bonds. See the next section for more information on how EE and I-series bonds differ.

There are two types of savings bonds currently issued by the US Treasury: EE-bonds and I-Bonds.

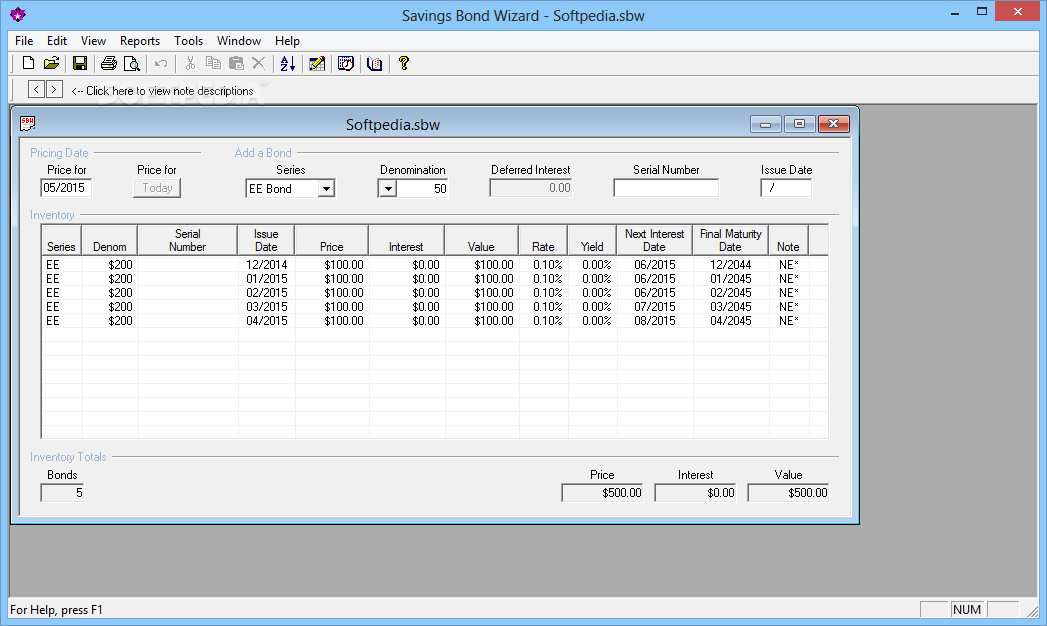

Savings bond wizard windows 10 full#

While savings bonds are not technically insured like a typical bank account, they are backed by the full faith and credit of the US government, making them essentially as safe as an FDIC/NCUA insured savings account. Essentially, they are small pieces of US government debt that helps finance day-to-day operations of the US government. Savings bonds are a type of risk-free fixed income investment issued by the United States Treasury. United States Treasury Savings Bonds What are Savings Bonds? I had paper bonds, but they are now missing.Converting paper bonds to electronic bonds.What is my savings bond's interest rate?.What is the difference between an EE-Series Bond and an I-Series Bond?.Here, please treat others with respect, stay on-topic, and avoid self-promotion.Īlways do your own research before acting on any information or advice that you read on Reddit.

Savings bond wizard windows 10 how to#

Get your financial house in order, learn how to better manage your money, and invest for your future. Private communication is not safe on Reddit. Scam alert: Ignore any private messages or chat requests.

0 kommentar(er)

0 kommentar(er)